As seniors get older and their health deteriorates, they have an increasing need for assisted living and health care services to take care for them. Unfortunately seniors don’t always have the monetary resources to afford them.

In addition to these increasing expenses, seniors may also have life insurance policies on their lives that they no longer need as their children have grown up and are self-sufficient. Or even worse, they may have to pay premiums on these policies that they cannot afford.

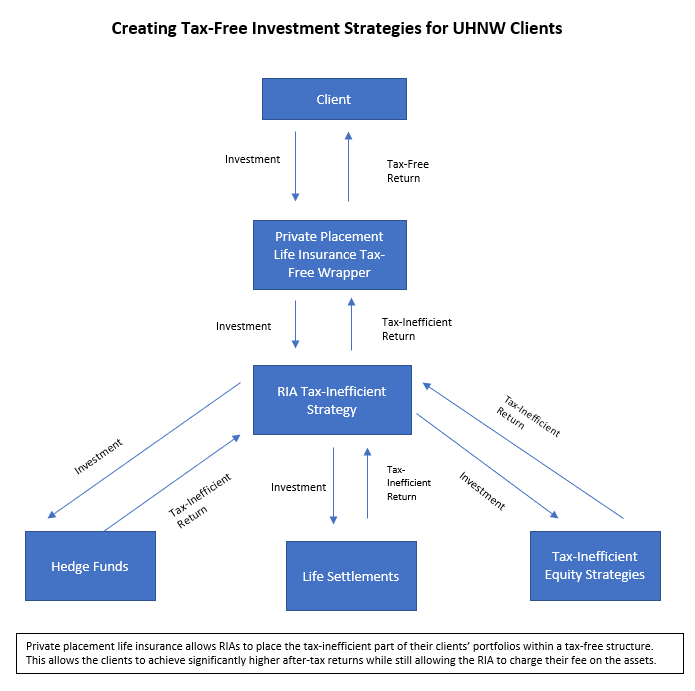

A life settlement is an option for these individuals that can solve the problem of having a life insurance policy they don’t need while trying to manage other expenses that they do need help paying for. A life settlement is a financial transaction in which a policy owner of a life insurance policy sells his policy in exchange for a cash payout (and/or part of the death benefit when the policy owner dies). The policy owner no longer has to pay any premiums on the policy as the buyer of the policy is now responsible for making all ongoing premium payments. The buyer of the policy will then get the death benefit on the policy when the seller of the policy dies.

By selling the policy, the senior receives significantly more than he or she would have received if the policy was just cancelled. The senior can then use these proceeds to pay for the care or expenses that they need.

So what’s the problem then with life settlements?

The problem has to do with the excessive amount of commissions being paid to the broker who helps the policy owner sell the policy. These commissions can range from anywhere from 15% to 30% of the total offer for the policy. In many cases, the policy owner has no idea that the broker is getting such a large percentage of the offer that would otherwise go to the policy owner.

Imagine your client wanted to downsize the house they were living in so that they could move into a smaller place that was easier to maintain and take care of. And imagine there was a buyer willing to pay $500,000 for it. But in order for your client to sell the policy, they had to pay $100,000 to the broker who was helping your client sell it. Which of course means that your client will only get $400,000. Not an easy pill to have to pay someone for a few days worth of work is it? This is especially true when the typical commission in the real estate market is only 6% or $30,000.

The goal of a life settlement broker is to help get the client the highest offer possible while working with any concerns or conditions the client may have. A life settlement broker accomplishes this by contacting a number of regulated life settlement providers and helping the client pick the potential buyer that will offer them the highest price possible while also closing on the transaction in the shortest amount of time. The higher the offer price, the larger the commission the broker can get. Less reputable brokers have even been known to utilize providers that pay them higher commissions even if the total payout to the client would have been higher elsewhere.

Why are life settlement broker commissions so high?

Lack of Transparency: Transparency in the life settlement industry is not one of its shining features. While many states require that broker commission be disclosed at the closing of the transaction, very few sellers of policies are savvy enough to ask what commission percentage an individual broker takes before engaging his services.

Lack of Efficient Competition: In an efficient marketplace multiple players compete for the same client’s business—thereby keeping prices in check. In such a marketplace if one business is charging too high of a fee, the client will go to another business that offers the same service for less.

Unfortunately the life settlement broker market is not such a market place. A life settlement broker is usually referred to a client by a trusted advisor: CPA, wealth management firm, assisted living professional, etc. The client reaches out to the life settlement broker assuming that the life settlement broker his advisor referred is the best fit for him. The client is not efficiently shopping various life settlement brokers and taking into account how much each charges as commission.

This means that the broker can charge an outrageously high commission with little worry that the client will go somewhere else.

How can clients can get better value from their life settlement transactions?

Ask for all commissions to be disclosed upfront and at closing: The client should ask that the broker disclose upfront how much of a commission (or what percentage) they will be getting paid if the transaction closes. Furthermore, the client should ask that as a condition of closing all commissions be disclosed by the provider buying the policy. It’s important to remember that the commission percentage is not set in stone. The seller is free to negotiate with the broker upfront on the percentage of their offer they are willing to give to the broker. If the broker’s percentage is too high, the seller should look for more competitive brokers. The client should also research life settlement providers and ensure that the broker is working with a wide array of life settlement providers. This allows the client to get offers from multiple sources and increases the chance of the client getting the highest possible price. Some life settlement brokers have been known to work only with life settlement providers that offer them the highest commissions.

Work with an actuarial consultant and a qualified attorney: An actuarial consultant can help appraise the market value of the policy and inform the client what the policy is worth before they sell it. This helps prevent the client from accepting a low offer on the policy. The actuarial consultant can also obtain offers from major providers to ensure that the client gets the highest offers possible for the policy.

A licensed attorney can help clients sell their policies in almost all states without the need for a broker. The attorney can handle all contract negotiations and ensure that the client’s best interests are protected. An actuarial consultant can help appraise the market value of the policy and inform the client what the policy is worth before they sell it. This helps prevent the client from accepting a low offer on the policy. The actuarial consultant can also obtain offers from major providers to ensure that the client gets the highest offers possible for the policy.

Collectively an actuarial consultant and qualified attorney can help act in the client’s best interests while obtaining the most value for them.

0 Comments